Trading Psychology: Rewire Your Brain for Maximum Performance in Today’s Markets

By Scott Redler

Chapter 8: Why You Need Loss Limits

"Take calculated risks. That is quite different from being rash."

-General George S. Patton

Risk tolerance is a tricky, tricky subject. We assume we know what we can handle.

When things go your way, you can handle pretty much anything. But things get tricky real fast when you lose $5,000.

When things go your way, everything is easy to handle. But things get tricky real fast when you lose $5,000 #tradingpsychology

Because when you take a lot of risk and it pays off, you forget how much money you could have lost if things went bad.

In late 2020, speculative stocks and assets of all kinds were BOOMING - small caps, alt energy names, SPACs, cryptos, alt coins, etc. And the more risk you took, the more money you made.

People kept coming out of the woodwork asking me "should I become a pro trader?" I made a video about this in January 2021, warning our community that the good times don't last forever:

because there’s the other side of the equation… when things fall off a cliff.

Risky stocks and assets started dropping in February 2021, led by the collapse of Cathie Wood’s Ark Innovation ETF (ARKK):

Millions of traders left the market because they couldn’t handle the other side of the coin.

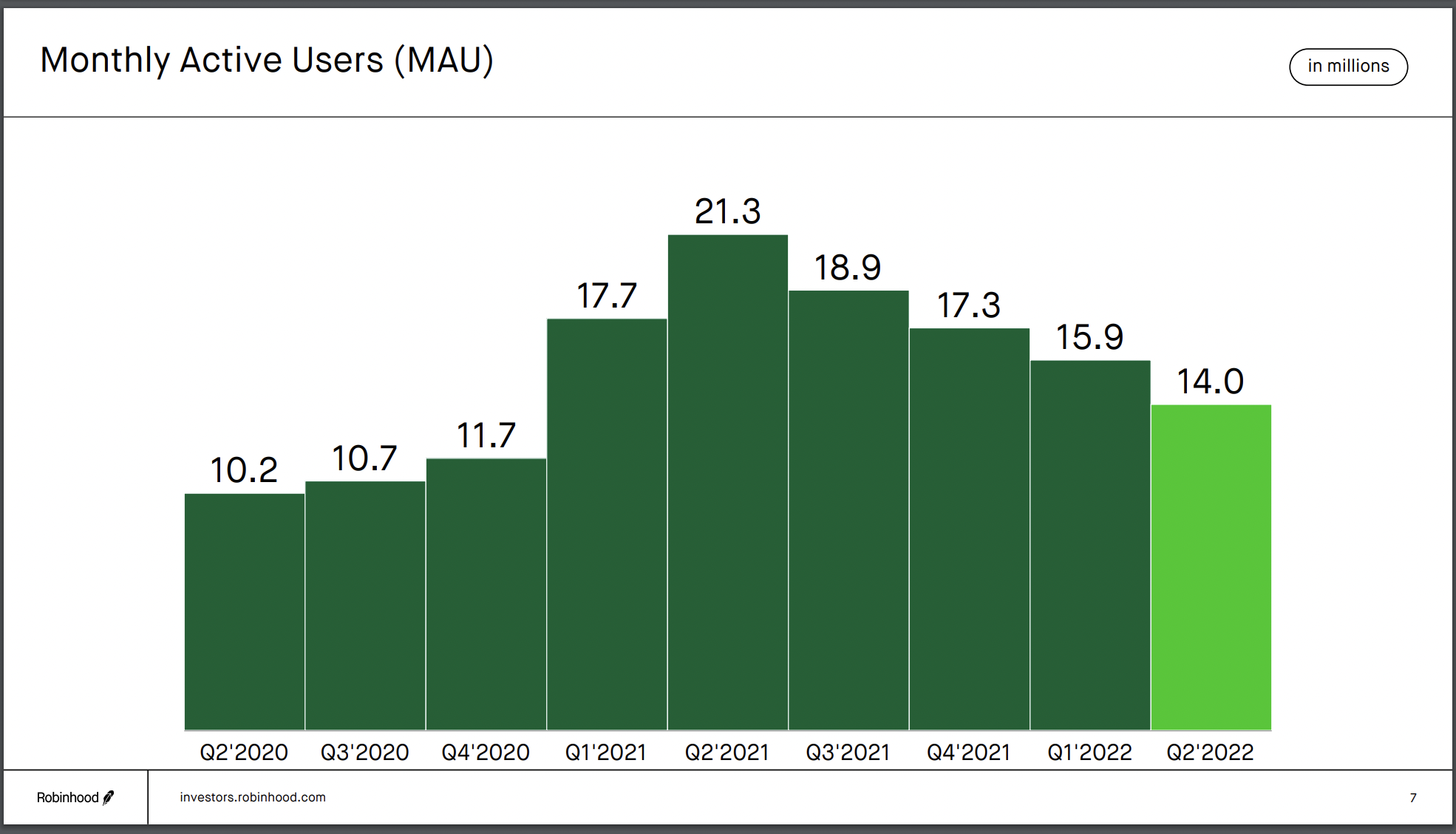

From Q2 2021 to Q2 2022, Robinhood lost 7.3 million active users:

So do you really know what you can handle when things go bad?

This is where your past comes in. In the last chapter, I asked you to look at your trading history, and see what’s worked for you in the past, and where things went wrong.

I want you to go back and focus on that bottom 10% of trades, the ones that cost you real money. The ones that made you say “I can’t believe I did that!”

For each one of those trades, think about how you reacted emotionally in the moment. Because when you have a strong negative emotional reaction to a trade gone wrong, it's often sign that you took too much risk. One good reason to keep a trading journal is so you can write down how you feel right on the spot.

You can separate your reactions to losses into two categories.

Category #1: It Was a “Good” Loss

There are situations where you will do everything right, and things just didn’t work out. If that’s the case, odds are you were taking the right amount of risk for your personality. So you made the right decisions.

Category #2: It Was a “Bad Loss”

And then there are the times where you ask yourself “how did I let things get so out of control?” That’s a sign your size in the trade was too big, or you didn’t get out fast enough. You took too much risk for your own good.

You can also look at how you performed during different time periods. Let’s say you have a good run in an up year, doubling your money. Then the market turns down. If you lose around 10% to 15% of your money, odds are you took a reasonable amount of risk and you have the right management rules. You may not be happy when you're down, but you’re surviving well enough.

If you lose more than 20-25% of your gains on a drawdown, then you are going to be disturbed.

So you’re probably asking “what do I do with this information?” You must figure out where your limits are. You need to find a balance between following your strategy and avoiding emotional pain.

I recommend that an active trading account have daily, weekly, and monthly loss limits.

Meaning, you stop trading when you hit that loss limit. Set these numbers based on your historical drawdowns. If you found a $5,000 loss devastating, maybe you should set a limit at $2,000. So if you lose that $2,000, you tap out and live to fight another day.

Let me emphasize that we are talking about active short-term trading accounts. I do not actively trade my retirement account. I put money in like clockwork every month because I know the bull market wins over time.

By having monthly short-term trading loss limits, you take control of your trading, which is key to improving your trading psychology. The alternative is watching your account balance tick lower, knowing you should have stopped out $1,000 ago. Or $10,000 ago. Or $100,000 ago.

Nothing destroys your confidence like losing money doing something you know is wrong - like failing to stop yourself out.

Nothing destroys your confidence like losing money doing something you know is wrong #tradingpsychology

You may be asking why I talked about having a loss limit on an account, but not on individual trades.

In my trading system, I exit trades when they change based on my technical analysis rules. I don’t exit a losing trade based on a fixed percentage or dollar amount. I use technical analysis to tell me when the trade goes bad.

But you will likely find that your biggest losing trades could have been avoided if you had some simple sell rules. For example, I don’t hold stocks as swing longs when they are under the 8 & 21 day moving averages. Pretty basic, right? Yes. But it keeps me out of downtrending charts like these:

I can almost guarantee that having a set of sell rules you obey will build your confidence and sense of control over your trading.

Action Item: Set Loss Limits for Your Trading Account and Institute Sell Rules

Set daily, weekly, and monthly loss limits for your active short-term trading account. And decide on a set of sell rules for when you will exit individual positions. I sell out of losing positions based on my technical analysis system, but some traders prefer using a fixed dollar or percentage amount. Take your loss limits and sell rules, and put them near your computer, or wherever you’ll read them every day. The more you read them, the more likely they’ll set in.

Preface: Intro to the Book

Chapter 1: How to Get the Most Out of This Book

Chapter 2: 13 Reasons Why Traders Fail

Chapter 3: Why Rational Traders Don't Exist

Chapter 4: The Myth of the Consistent TraderChapter 5: Trading Ain't Easy

Chapter 6: Study Your Own Trading History, and Forgive Yourself

Chapter 7: Get Obsessed With Price Action

Chapter 8: Why You Need Loss Limits

Chapter 9: Why You Need a Daily Routine You Love

Make sure you enter your click the button below to sign up to get the next chapter!

Sign Up to Get New Chapter Notifications!